Top Influencing Factors to Use an Alternative Product

Top Influencing Factors to Use an Alternative Product

Visit GlassMagazine.com/November2017 to view the data and explore additional myths about product selection in Dodge’s complete report, “Exploding 9 Myths: How Architects and Contractors Really Select Building Products.”

Key Marketing Takeaways:

- Marketing and sales efforts to get architects’ attention should not stop after a project has started.

- Capitalize on the opening by avoiding generic selling, getting educated on the architect’s problem and recommending a solution designed specifically to address that problem.

- It’s important that a company website includes technical items like spec sheets, certifications and performance data to sell based on performance.

- Work to differentiate a product to the general contractor. Be very clear about the product’s unique value proposition to justify why it ought to be installed.

- Find ways for architects to learn about a product before the specification is written, because getting specified provides a very good shot of making it into the final project.

Product selection is a multi-party workflow that involves manufacturers, architects and contractors, and it’s a process with a lot of assumptions as to how products get specified. So how do architects and contractors really select the products that end up being used in their projects?

In a recent study, Dodge Data & Analytics, surveyed 170 architects and asked them how they go about selecting specific products. The survey also asked 150 contractors about their workflow and buying decisions and, for contrast, asked 99 building product manufacturers how they believed the others would answer these questions.

The results identify several areas of opportunity for manufacturers to support their sales and marketing efforts where their own assumptions may previously have held them back. This article details five areas where there seems to be a disconnect between the conventional wisdom, and how the players in the industry truly operate.

Myth #1: There’s little opportunity for manufacturers once a project has already started.

Many manufacturers seem to believe that once the design phase of a project begins, many if not most, of the product decisions have already been made and there’s little chance of getting their products specified. Contrast this with what architects actually say. Only 8 percent of architects claim to be pre-selecting more than three quarters of their products, while a third of building product manufacturers believe this is the case.

According to the study, building product manufacturers may be overestimating the extent to which architects are pre-selecting products, and may therefore be missing out on an opportunity.

Myth #2: Architects have no interest in new products.

According to the study, most building product manufacturers report they believe that architects aren’t interested in learning about, or using, new products and don’t have the time to research them. However, more than half of architects claim their firm encourages them to learn about new products. Only 16 percent of building product manufacturers thought this likely to be true. Another key finding is that manufacturers tend to significantly overestimate the power that a product’s brand has in influencing an architect’s product choice.

There’s much more of an open door than most manufacturers perceive. Just because a product may be new or outside the mainstream does not mean it isn’t exactly what architects are seeking.

Myth #3: Only low-cost products make the final cut.

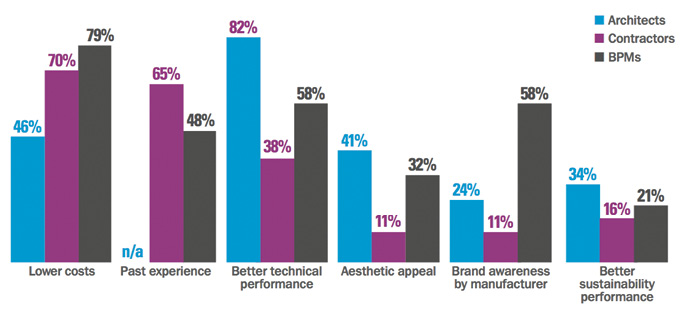

Is cost really king? Building product manufacturers believe very strongly that, more than any other factor, lower cost is the top influence on an architect’s decision to pick an alternate product. But this turns out to not always be the case. Fewer than half of the surveyed architects rank cost as the top consideration. Though, it’s worth noting that contractors should also be part of the discussion, too, as they feel a bit more strongly that this is the case (See graph above).

What really drives the decision? For architects, better technical performance is by far the most important factor—something that manufacturers underestimate significantly. Make sure the technical requirements and performance of a product are strongly conveyed so that it can be taken into account throughout the selection process.

Myth #4: Contractors have little influence over product selection.

This is not necessarily true. Contractors do have the ability to swap out a product selected by an architect, as long as it meets the specifications, even when the product has a design or aesthetic role.

The Dodge survey differentiated in its questions between technical products and design products, the latter being those that contribute to the aesthetic of the building, that the user will see and that architects care deeply about. Technical products, of course, are critical, but don’t necessarily contribute visually to the building itself. And there’s some difference here.

Contractors tend to report a higher success rate of approving an alternate product than manufacturers assume, and the split is particularly striking on the design side.

Myth #5: Few products in the specification actually get installed.

A whole set of products have been specified. But how many of these end up being purchased and installed in the final project? Seventy-five to 90 percent of specified products end up installed, according to almost half of the architects Dodge surveyed. Only 21 percent of building product manufacturers believe this level of installation is taking place.

Manufacturers tend to have a much more pessimistic view, but again, the takeaway is that there is great opportunity all the way through the design and build workflow.

The key to making an impact on architects and contractors is having the right approach. Remember that at every phase in a project—from design to bidding to construction—the window of opportunity is open. Communicate clearly about certain products and their value proposition in a way that is tailored to address the specific problems an architect or contractor faces during that phase of the project.

Most importantly, include sales and marketing staff in the conversation about assumptions and make sure that everyone understands the rationale for doing things differently. Successfully changing long-entrenched habits will require clear communication and collaboration across the company, but the results will be well worth the effort.